- The Capital Circle

- Posts

- The Real Reason Winners Look Lucky

The Real Reason Winners Look Lucky

Luck is what it looks like when timing and awareness meet.

The Myth of Luck

When someone wins, people call it luck.

A friend invests early and doubles their money.

A creator’s idea catches fire.

A founder builds something that suddenly takes off.

From the outside, it looks random. But it rarely is. The ones who seem lucky are usually the ones who noticed first.

They were paying attention when others weren’t. They saw the small signs that something was shifting and acted before it became obvious.

Luck is often just timing that no one else saw coming.

The winners didn’t stumble into opportunity. They recognized it early and were ready when it showed up.

How Winners Actually Create Their “Luck”

Winners don’t have secret information. They build habits that help them notice change early.

They look for what’s starting to grow before everyone else notices. They track patterns, conversations, and small shifts in attention. Over time, they get better at connecting those small signs to bigger outcomes.

Today, that process is easier than ever. Information moves fast, and tools can help you see it before the rest of the world does.

Platforms like AltIndex track real-time data from places like Reddit, watching which companies are being talked about more often and with more excitement.

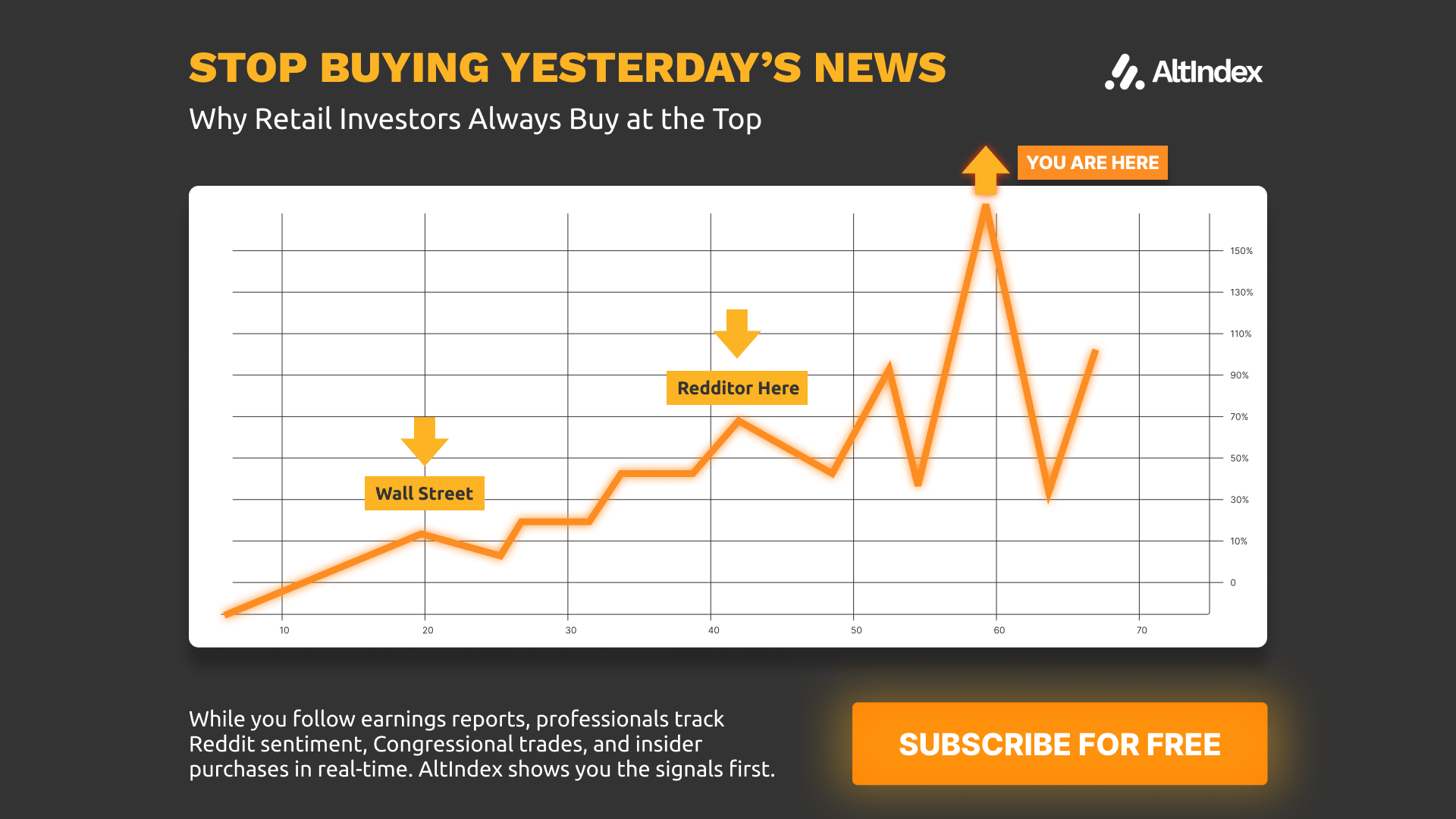

Why Retail Investors Always Buy at the Top

You buy after CNBC reports the story.

Wall Street bought when Reddit mentions spiked 3,968%.

You buy after "strong earnings."

Wall Street bought when insiders loaded up $31M beforehand.

You buy after "analyst upgrades."

Wall Street bought when Congress filed their positions first.

The pattern is obvious: You get yesterday's news. They get tomorrow's signals.

While you're reading quarterly reports, professionals track Reddit sentiment, Congressional trades, and insider purchases in real-time.

AltIndex monitors the same signals Wall Street uses: 50,000+ Reddit comments daily, every Congressional filing, insider transactions from 500+ companies.

Every week, we send you the stocks showing the strongest signals before they hit mainstream financial media.

And we’re giving you a 7 day free trial of our app, so you can see new stock narratives happening in real time.

Stop being the last to know.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

It’s not guessing. It’s awareness built on data. The earlier you see a direction forming, the more time you have to learn, prepare, and act while everyone else is waiting for proof.

Luck favors the ones who notice first.

The Patterns Winners Watch For

Awareness is built by habit. People who seem to have perfect timing aren’t guessing, they’ve trained their attention. They know what signs to look for and where to look for them.

Here are a few patterns they watch for:

1. Rising curiosity.

Pay attention to what people start mentioning more often. Small trends in conversation often grow into large movements later.

2. Shifts in behavior.

Watch how people spend their time and money. When habits change, markets follow.

3. Momentum in small spaces.

Many big ideas start in small online communities before breaking out. The earlier you notice energy forming, the better your position.

4. Uneven results.

If something is working unusually well for a few people, it’s worth studying. Outliers reveal direction before averages do.

5. Consistent attention.

When an idea, product, or topic keeps coming up from different places, that repetition means something.

These patterns are visible if you take the time to look. Winners don’t rely on luck, they collect small pieces of evidence until the next move becomes obvious.

Why Timing Beats Effort

Hard work matters, but it doesn’t matter evenly. Effort spent at the right moment produces more than the same effort spent too late.

Timing multiplies results. The earlier you act, the more space you have to learn, improve, and build momentum before everyone else catches up.

Examples are everywhere:

A business that enters a new market early has room to grow before competition arrives.

An investor who buys when interest is still building captures growth others miss.

A creator who experiments with a new platform before it peaks benefits from faster reach and lower competition.

This doesn’t mean rushing into everything. It means learning to move when things still look uncertain but promising. The goal is to be early enough to gain leverage and steady enough to hold it once it comes.

Effort without timing can feel like running in place. Effort paired with timing compounds.

Today’s Move

Pick one area of your life where being early would matter. It could be a skill, an investment, or a new idea you’ve been considering.

Write down three ways you could spot change in that area before others do.

Maybe it’s following niche conversations online.

Maybe it’s tracking real data instead of headlines.

Maybe it’s studying what a few sharp people are paying attention to.

Then choose one method and start today. Observation is free, but it pays off only when you act on what you see.

Closing Thought

Luck looks random from the outside because attention is invisible.

The people who seem lucky are often just more aware. They see what’s shifting, they trust what they notice, and they move before it becomes obvious.

Timing is not magic. It’s a skill that comes from paying closer attention than everyone else.

Train your attention. Act when others hesitate. That’s how luck starts to find you more often.

Talk again soon,

Alex, Founder of The Capital Circle